Taxes - Individual and Corporate

INCOME TAX

The Tax Code of 1997 (Tax Code), as amended, defines Income Tax as a tax on a person's income, emoluments, profits arising from property, practice of profession, conduct of trade or business or on the pertinent items of gross income less the deductions if any, authorized for such types of income, by the Tax Code, as amended, or other special laws.

In this article we will focus on individual income tax, other individual taxes, and its requirements based on the updated TRAIN Law.

What is Individual Income Tax?

Individual income taxes, also known as personal income taxes, are levied on the earnings, salaries, dividends, interest, and other income that an individual receives throughout the course of the year. Typically, the state where the revenue is earned is the one who levies the tax.

Who are Required to File Individual Income Tax Returns?

1. Resident citizens receiving income from sources within or outside the Philippines

- Employees earning purely compensation income from two or more employers, concurrently or successively at any time during the same taxable year.

- Employees earning purely compensation income regardless of the amount, whether from a single or several employers during the calendar year, leads to a collectible or refundable return since the income tax was incorrectly withheld.

- Self-employed individuals (business and/or practice of profession).

- Individuals deriving mixed income, i.e., compensation income and income from business and/or practice of profession.

- Individuals deriving other non-business, non-professional related income in addition to compensation income not otherwise subject to a final tax.

- Those who are getting only compensation income from a single employer, even though the employer has correctly withheld their income, but whose spouse is not eligible for substituted filing

2. Non-resident citizens receiving income from sources within the Philippines

3. Aliens, whether resident or not, receiving income from sources within the Philippines.

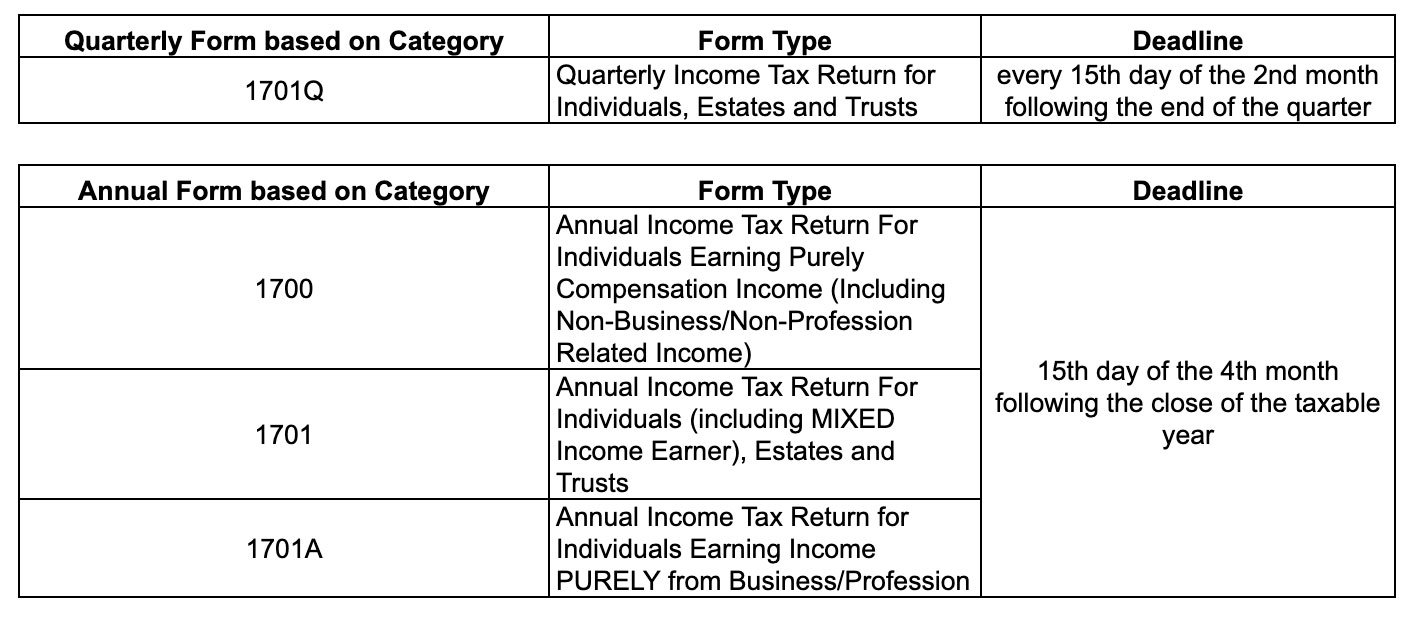

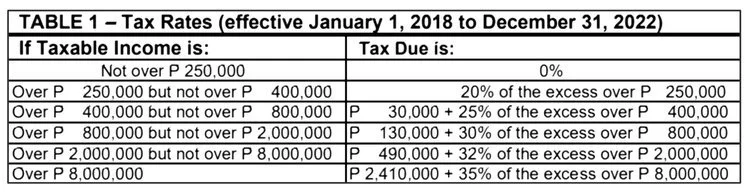

What are the Income Tax Forms that needs to file and its Deadline?

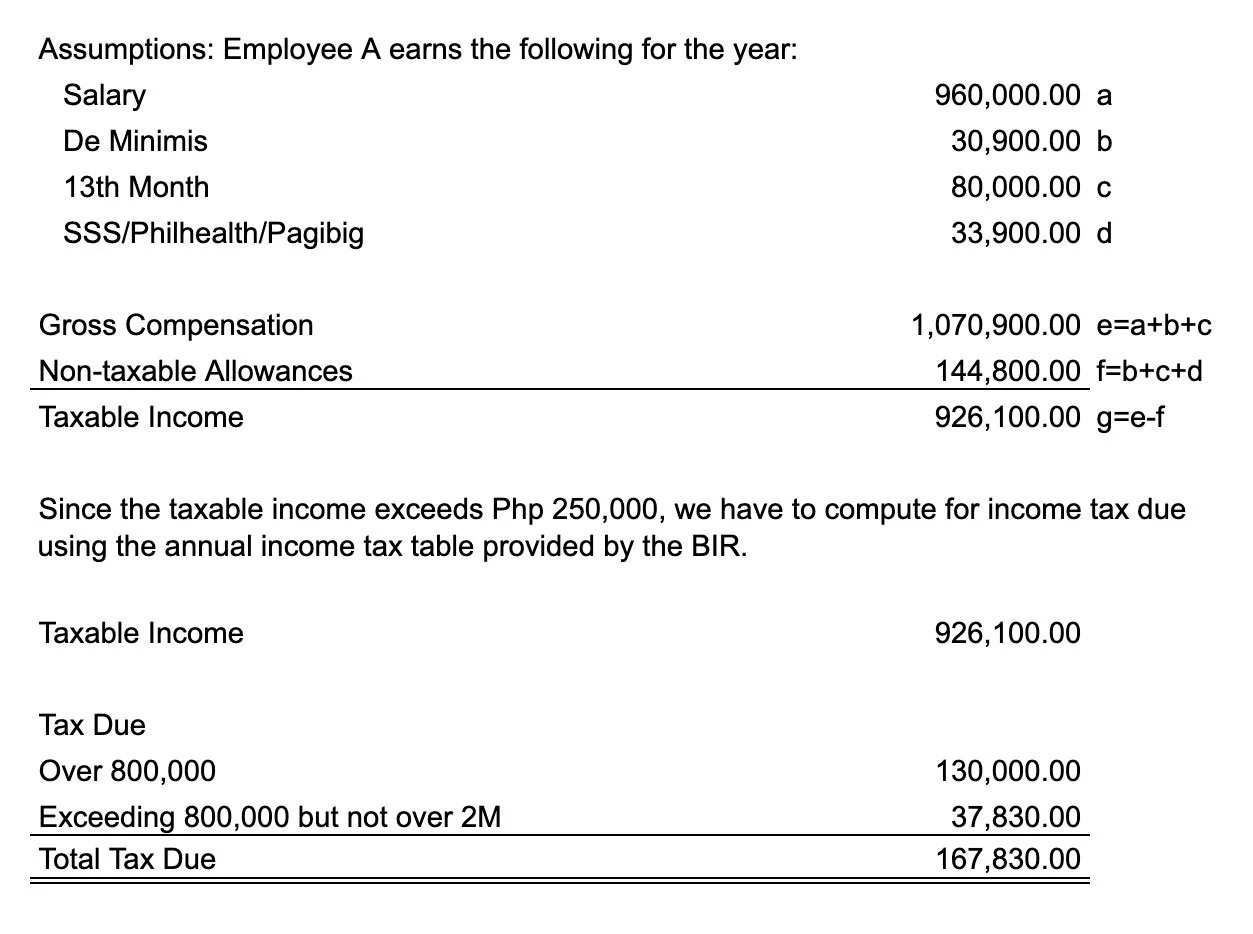

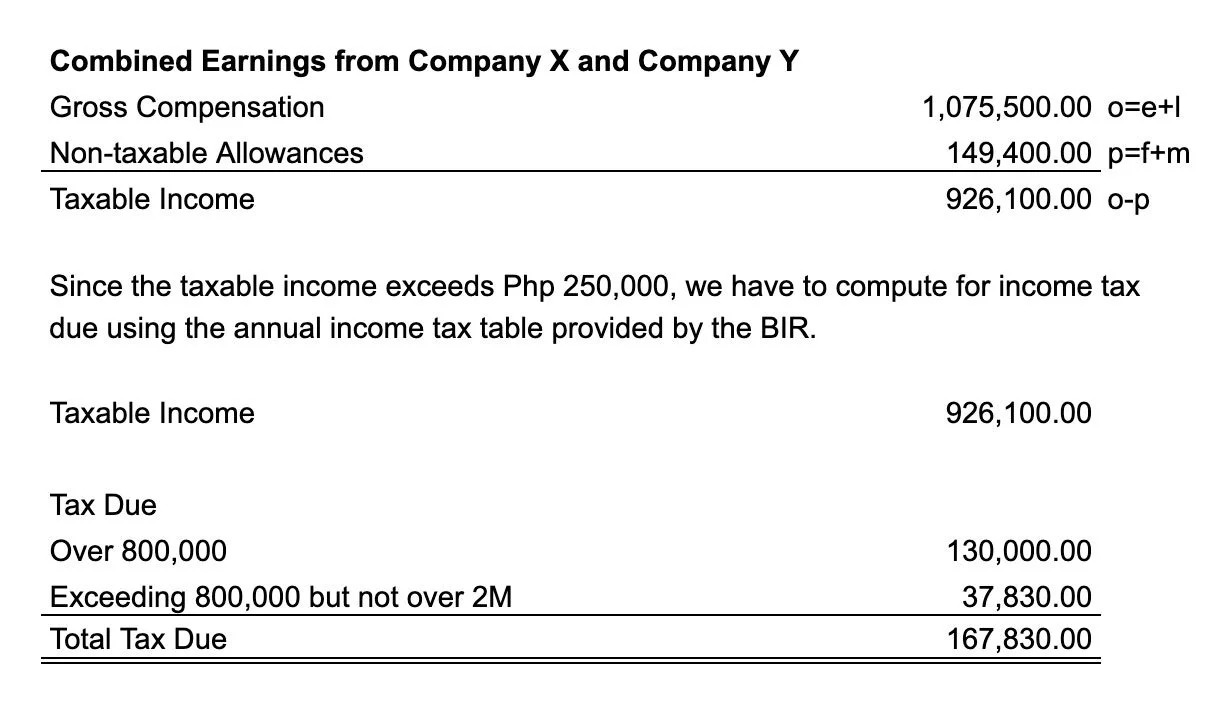

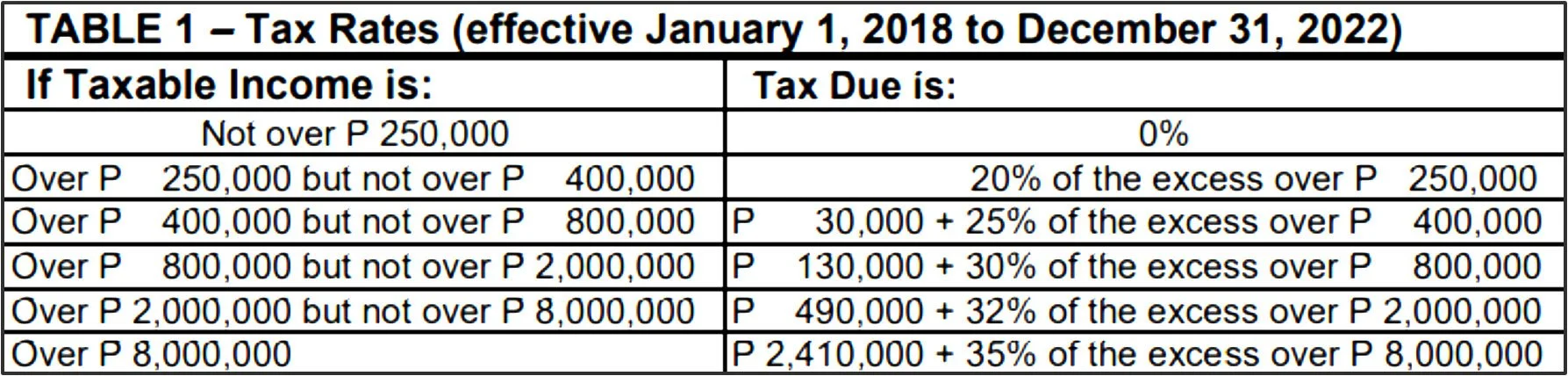

How to Compute Individual Income Tax?

Individual Income Tax falls under three categories:

1. Individual Earning Purely from Compensation

Every resident citizen who receives compensation income from any source, as well as every resident alien and non-resident citizen who receives compensation income from within the Philippines.

If you have just one employer during the tax year, your employer must file Form 2316, which serves as your income tax return. However, you must consolidate your wages and submit Form 1700 if you work for many employers during the same tax year.

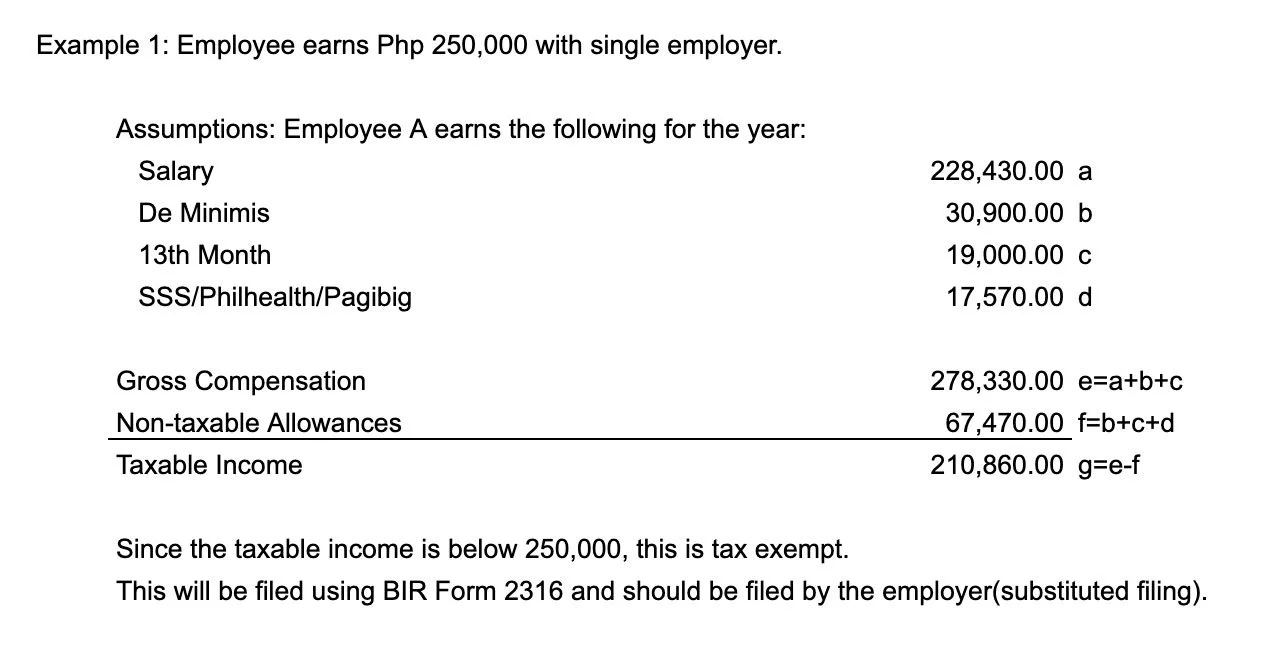

Example 2: Employee earns exceeding Php 250,000 with single employer.

Employers are accountable for deducting taxes from employees' salary and remitting them to the BIR.This will be filed using BIR Form 2316 and should be filed by the employer (substituted filing).

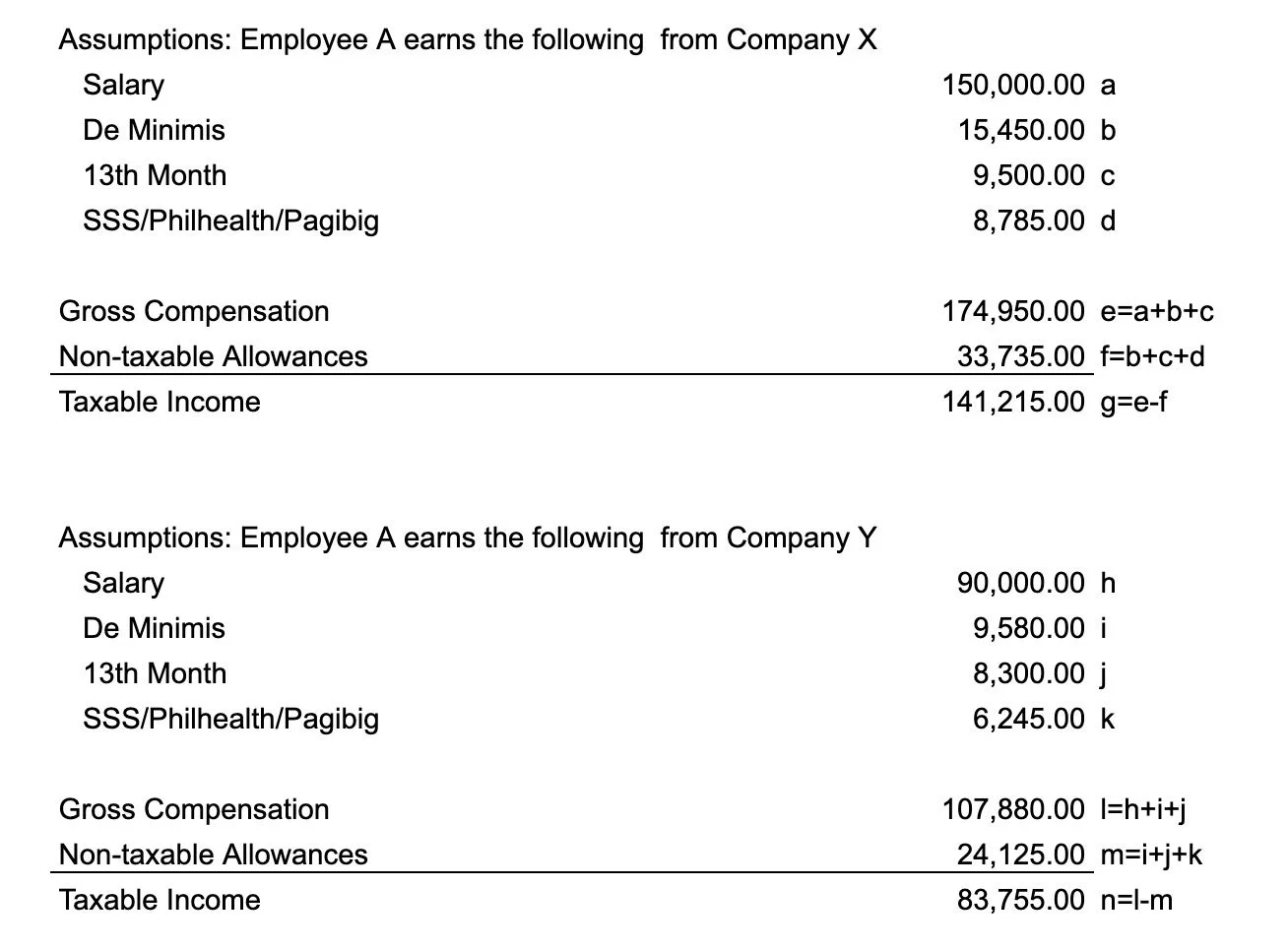

Example 3: Employee earns Php 250,000 with multiple employer.

We must consolidate the earnings because the employee has multiple employers for the same taxable year.

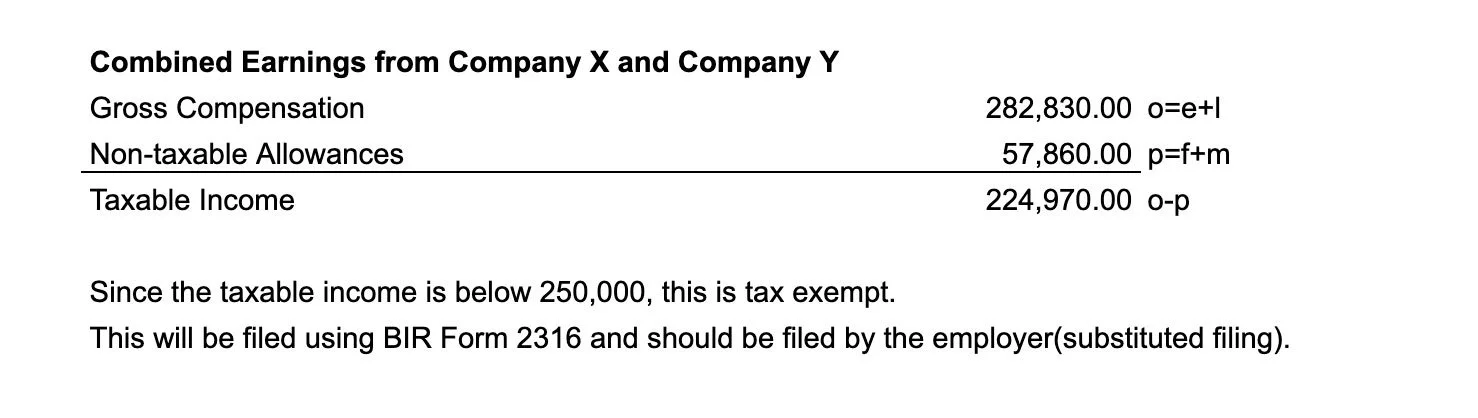

Example 4: Employee earns exceeding Php 250,000 with multiple employer.

We must consolidate the earnings because the employee has multiple employers for the same taxable year.

Employers are accountable for deducting taxes from employees' salary and remitting them to the BIR.This will be filed using BIR Form 2316 and should be filed by the employer(substituted filing).

2. Individual Mixed Income Earner

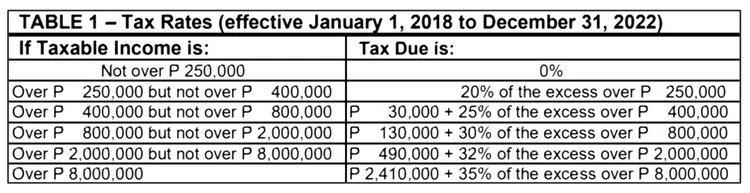

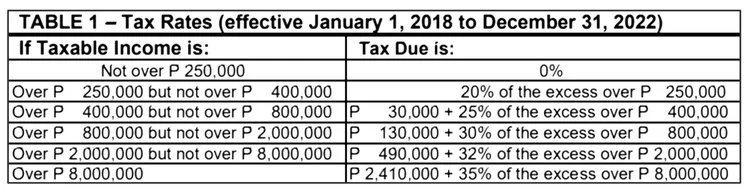

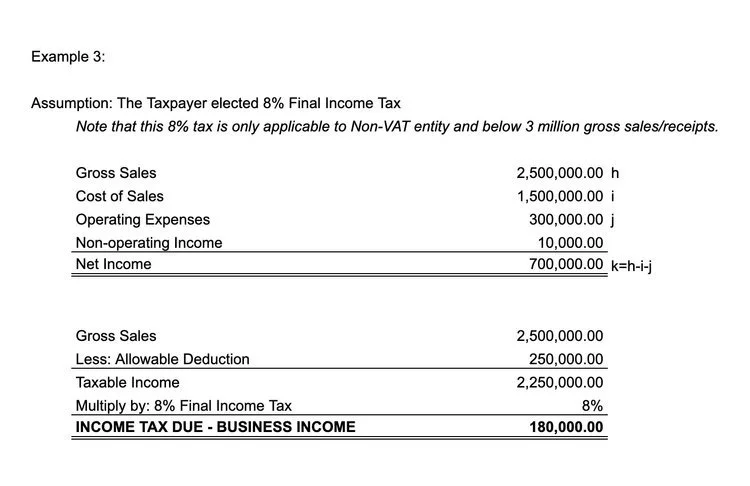

This are individuals earning income from compensation and from self-employment(business or practice of profession)For mixed income earner, the income tax rates applicable are:

1. The compensation income shall be subject to prescribed income tax table.

2.. The income from business or practice of profession shall be subject to the following:

a. lf the gross sales/receipts and other non-operating income do not exceed the VAT threshold, the individual has two options to be taxed:

a.1 Graduated income tax rates; OR

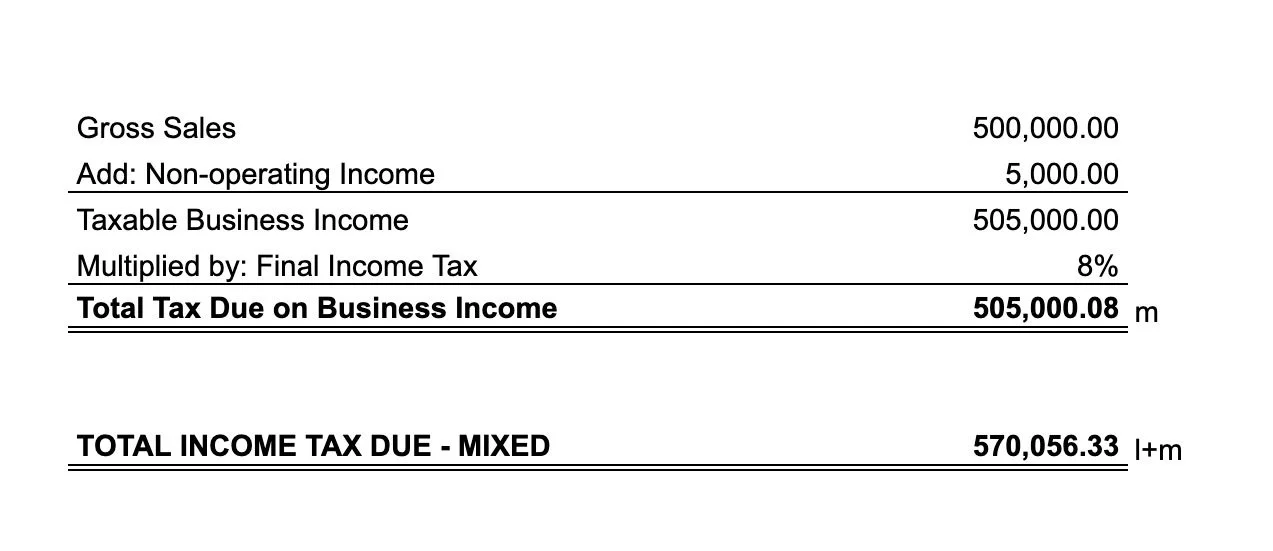

a.2 Eight percent (8%) income tax rate based on gross sales/receipts and other non-operating income in lieu of the graduated income tax rates and percentage tax.

b. If the gross sales/receipts and other non-operating income exceeds the VAT threshold, the individual shall be subject to the graduated income tax rates.

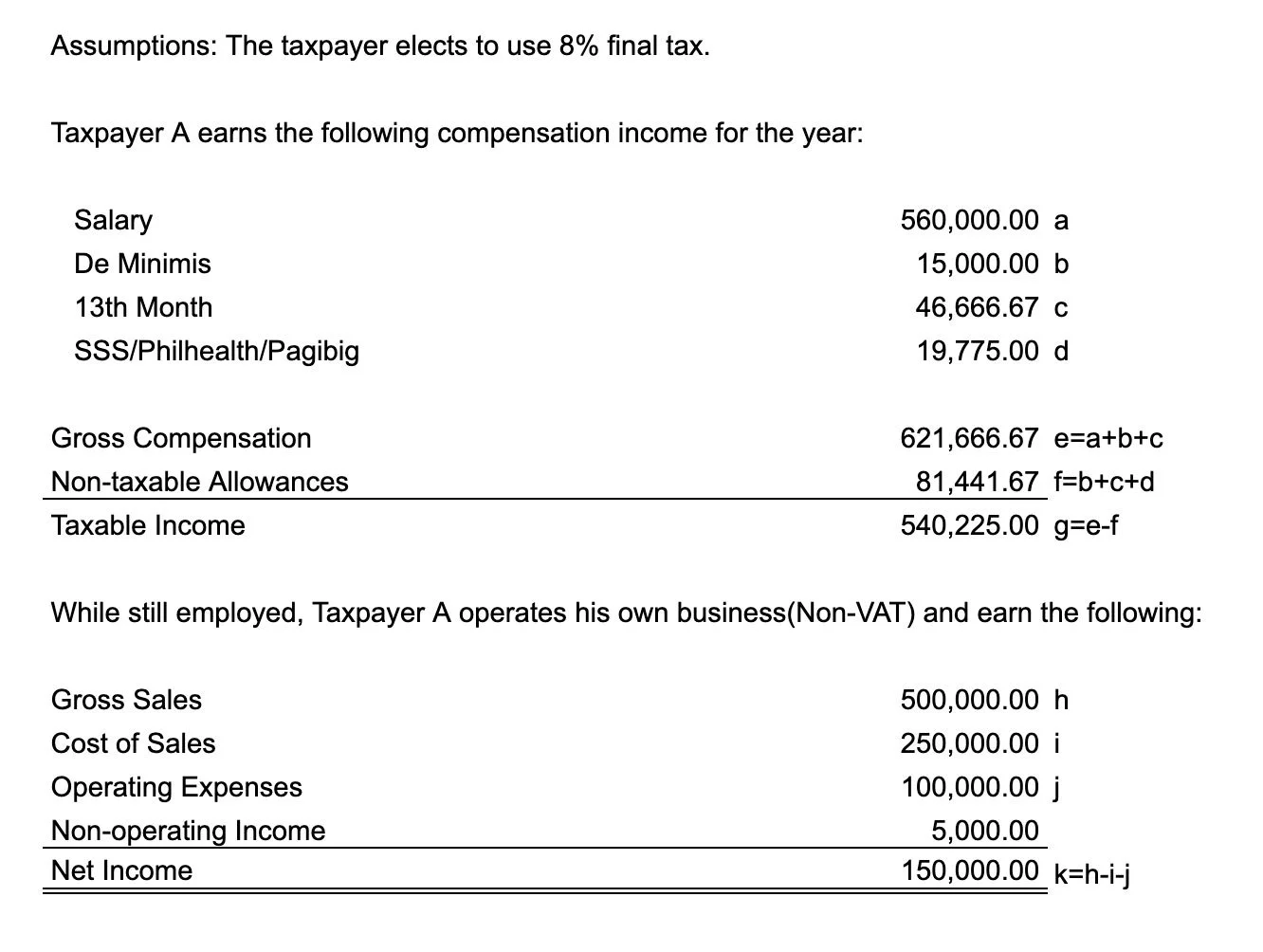

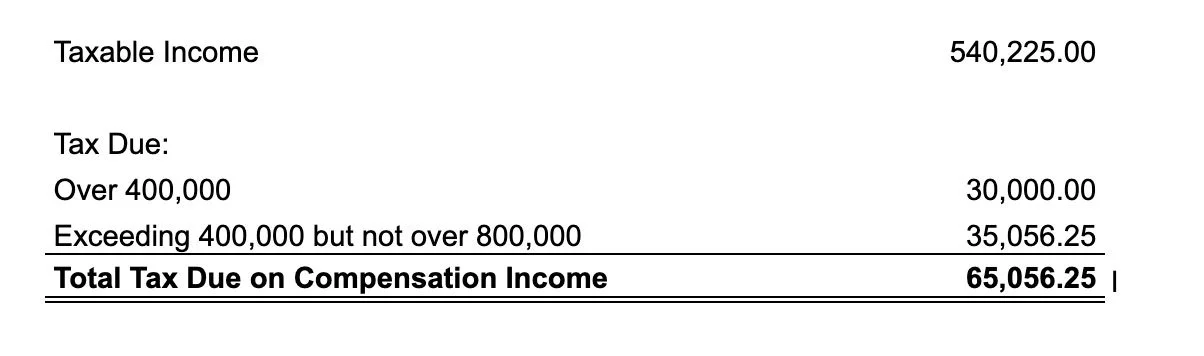

Example 1: Taxpayer A earns both compensation income and business income

Tax Due:

1. On Compensation

2. On Business Income

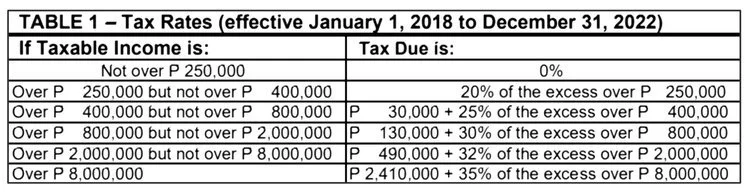

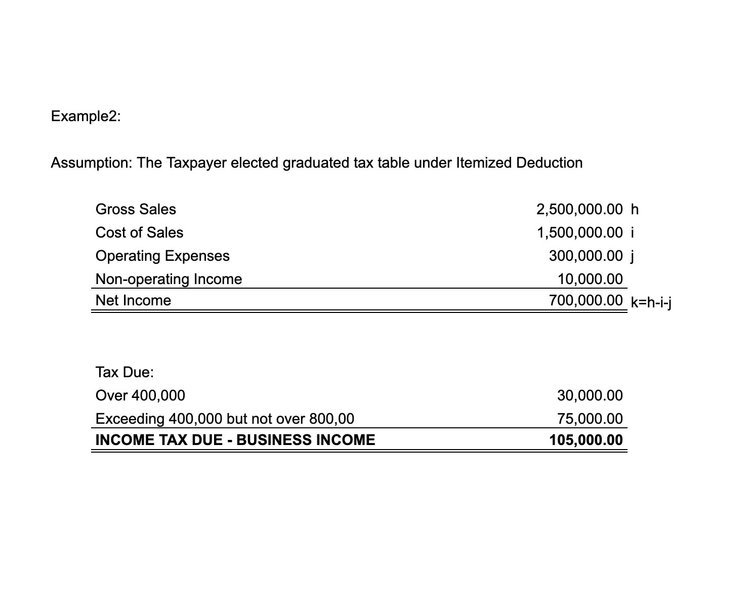

Example 2: Taxpayer A earns both compensation income and business income

Example 3: Taxpayer A earns both compensation income and business income

3. Individual Income Purely from Business

Individuals earning income PURELY from trade/business or from the practice of profession, to wit:

a. A resident citizen (within and without the Philippines);

b. A resident alien, non-resident citizen or non-resident alien (within the Philippines).

Those subject to graduated income tax rates and availed of the optional standard deduction as method of deduction, regardless of the amount of sales/receipts and other non-operating income; OR

Example1:

CORPORATE INCOME TAX

The Tax Code of 1997 (Tax Code), as amended, defines Income Tax as a tax on a person's income, emoluments, profits arising from property, practice of profession, conduct of trade or business or on the pertinent items of gross income less the deductions if any, authorized for such types of income, by the Tax Code, as amended, or other special laws.

What is Corporate Income Tax?

Corporate tax, often known as company tax or corporation tax, is a direct tax assessed on an organization's profits.

Who are Required to File Individual Income Tax Returns?

Due to pandemic President Rodrigo Duterte signed a law on March 26, 2021 to help the businesses to recover. This law is the Corporate Recovery and Tax Incentives for Enterprises (CREATE) Act. This CREAT Act amends the corporate income tax and other taxes related.

CREATE ACT:

Here is the summary of amendments to corporate income tax and other taxes:

In this article we will focus on corporate income tax based on the CREATE Act.

Who are Required to File Corporate Income Tax Returns?

Corporations including partnerships, no matter how created or organized.

Domestic corporations receiving income from sources within and outside the Philippines

Foreign corporations receiving income from sources within the Philippines

Estates and trusts engaged in trade or business

What are the Income Tax Forms that needs to file and its Deadline?

How to Compute Corporate Income Tax under CREATE Act?

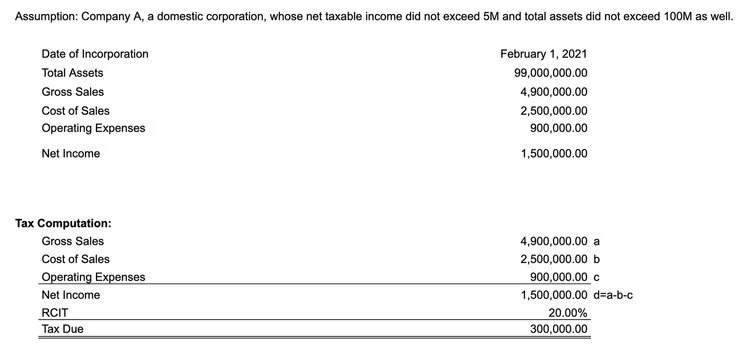

Example 1: Domestic Corporations with Net Taxable Income not exceeding Php 5M and/or total assets not exceeding Php 100M

Assumption: Company A, a domestic corporation, whose net taxable income did not exceed 5M and total assets did not exceed 100M as well.

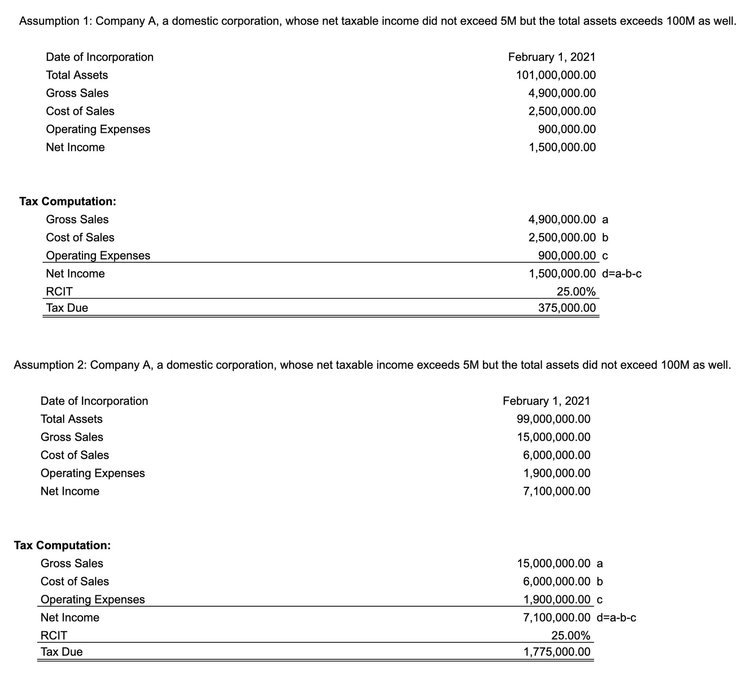

Example 2: Domestic Corporations with Net Taxable Income exceeding Php 5M and/or total assets exceeding Php 100M

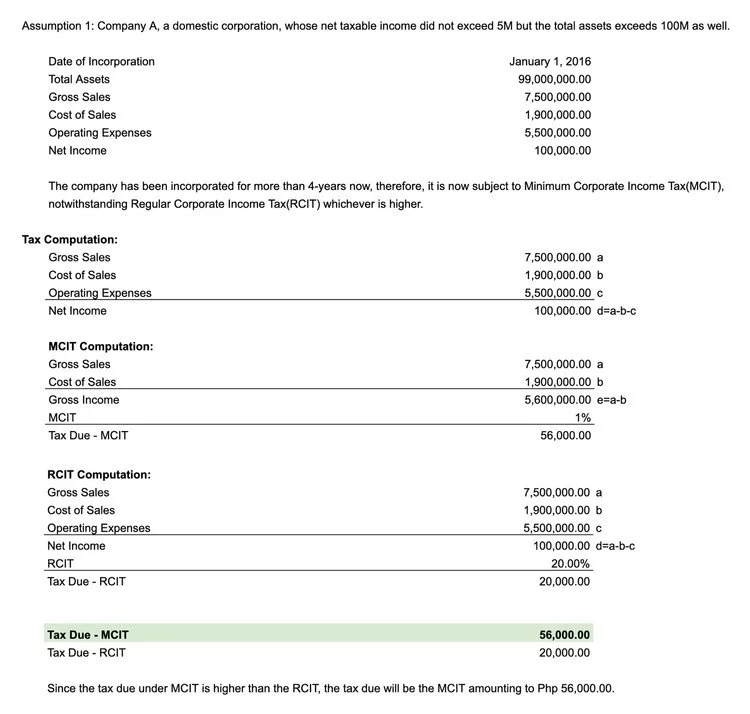

Example 3: Minimum Corporate Income Tax (MCIT) for Domestic Corporations

Example 4: Non-Profit Proprietary Educational Institutions and Hospitals

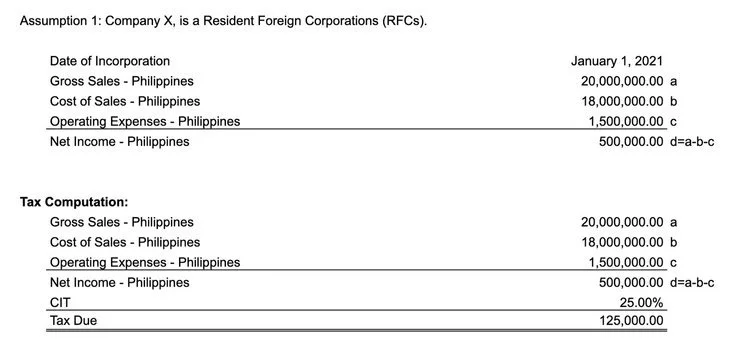

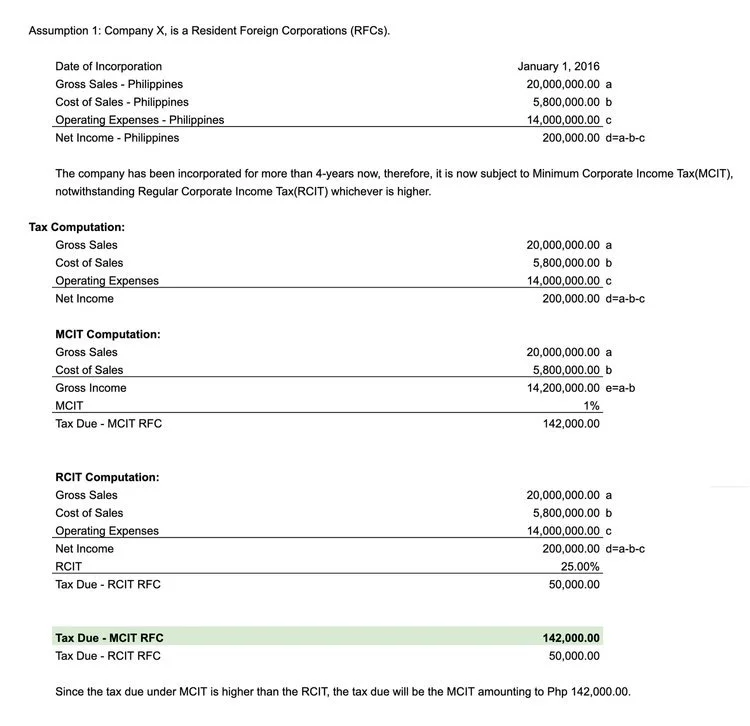

Example 5: Resident Foreign Corporations (RFCs)

Example 6: Resident Foreign Corporations (RFCs)

Example 7: MCIT Resident Foreign Corporations

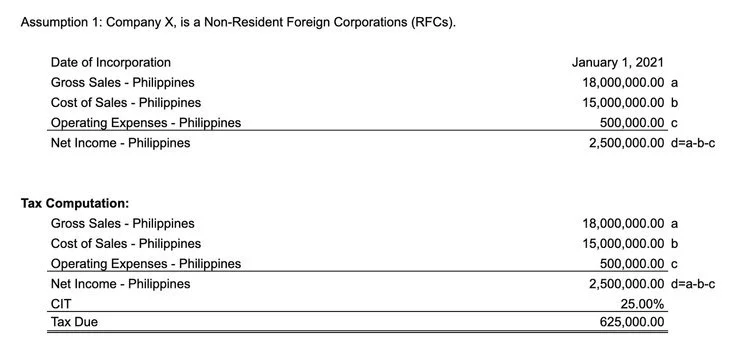

Example 8: Non-Resident Foreign Corporations (NRFCs)

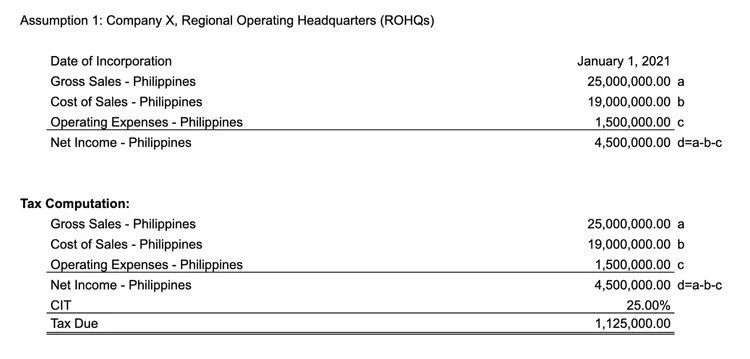

Example 9: Regional Operating Headquarters (ROHQs)

Have issues with your income tax compliances?